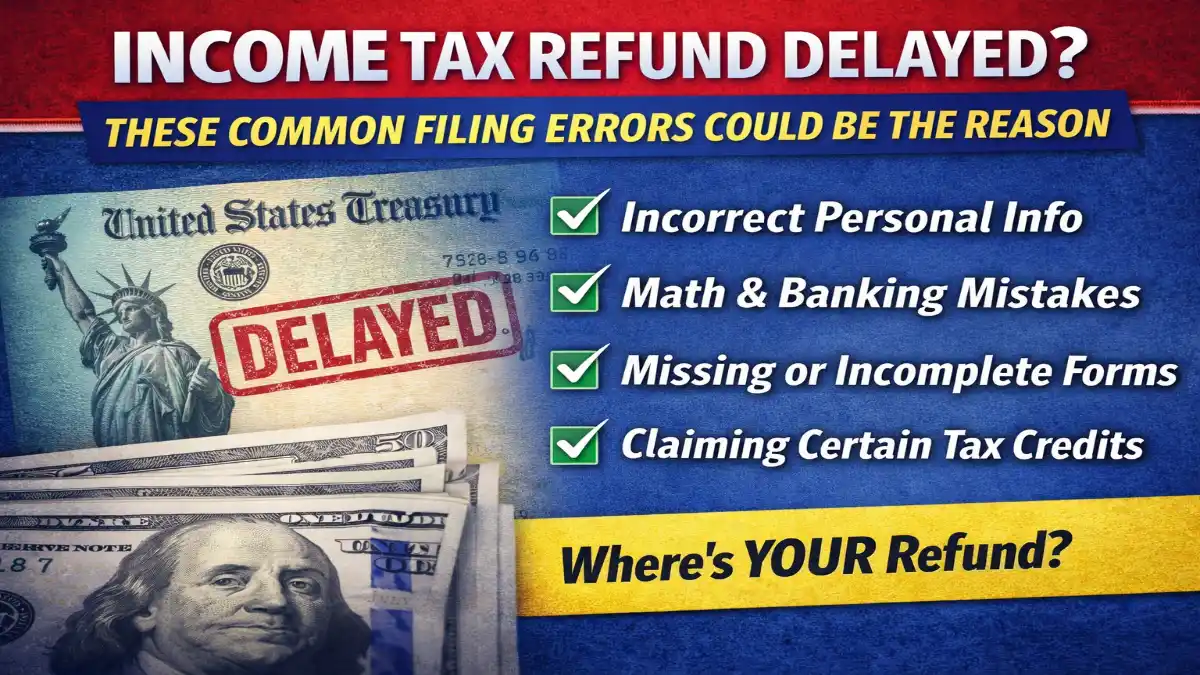

Waiting for your income tax refund can be frustrating — especially when others are already receiving their direct deposits. While most refunds are processed within the standard timeline, small discrepancies or filing mistakes can significantly delay your payment.

Here’s a closer look at the most common errors that can slow down your refund and what you can do to avoid them.

Why Refund Delays Happen

The Internal Revenue Service processes millions of returns each filing season. Most electronic returns with direct deposit are issued within 7 to 21 days. However, returns flagged for review due to errors or inconsistencies require additional verification, which can extend processing times.

Even minor mistakes can trigger manual review.

Common Filing Errors That Cause Delays

1. Incorrect Personal Information

Mistakes in your name, Social Security number, or filing status can lead to processing holds. Information must match IRS records exactly.

2. Math Errors

Although electronic filing software reduces calculation mistakes, manual entries or incorrect figures can still cause discrepancies.

3. Incorrect Banking Details

Entering the wrong account or routing number can delay or misdirect your refund. Double-check your direct deposit information before submitting.

4. Missing Forms or Documentation

If required forms such as income statements or credit documentation are incomplete or missing, the IRS may pause processing.

5. Claiming Certain Tax Credits

Returns claiming credits like the Earned Income Tax Credit or Child Tax Credit may require additional verification, which can extend processing time.

6. Identity Verification Issues

If the IRS suspects potential identity theft, it may request additional verification before releasing funds.

How to Check Your Refund Status

You can track your refund using the official “Where’s My Refund?” tool on IRS.gov. The system updates once daily and shows whether your return is:

- Received

- Approved

- Sent

Make sure you have your Social Security number, filing status, and exact refund amount ready.

What to Do If Your Refund Is Taking Longer

If your refund has not arrived within the expected timeframe:

- Verify your return for errors

- Confirm your banking information

- Check for IRS notices or requests

- Allow extra time during peak filing season

If it has been more than 21 days since e-filing and there are no updates, you may consider contacting the IRS directly.

How to Avoid Refund Delays in the Future

To reduce the chances of delays:

- File electronically

- Use reputable tax software

- Double-check all personal and banking information

- Submit complete and accurate documentation

- File early during the tax season

Accuracy is the key to faster processing.

Final Thoughts

Income tax refund delays are often caused by small but important filing errors. While the IRS processes most returns quickly, discrepancies in personal details, banking information, or tax credits can slow down your payment.